What is Digital Payment?

Digital payment is a way of payment that is made through digital modes. In digital payments, payer and payee both use digital modes to send and receive money. It is also called electronic payment. No hard cash is involved in digital payments. All the transactions in digital payments are completed online. It is an instant and convenient way to make payments.

Currently available digital payment systems include Banking cards, Digital wallets, Unified Payment Interface (UPI), Unstructured Supplementary Service Data (USSD), Immediate Payment Service (IMPS), Real Time Gross Settlement (RTGS), National Electronic Fund Transfer (NEFT), Aadhar Enabled Payment System (AEPS) and Mobile banking.

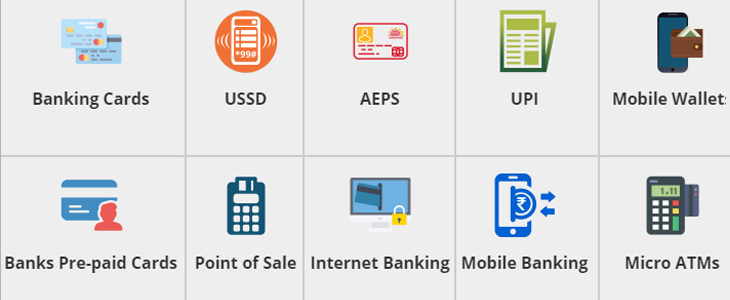

Types of Digital Payment

These are the types of digital payment which are given below:

- Banking Cards

- Unstructured Supplementary Service Data (USSD)

- AEPS

- UPI

- Mobile Wallets

- Banks Pre-paid Cards

- Point of Sale

- Internet Banking

- Mobile Banking

- Micro ATMs

- Qr Code Based Payments System

- Smart Card

- Electronic Cheque

Banking Cards

Banking cards offer consumers more security, convenience, and control than any other payment method. The wide variety of cards available – including credit, debit, and prepaid – offers enormous flexibility, as well. These cards provide 2-factor authentication for secure payments e.g secure PIN and OTP. RuPay, Visa, MasterCard are some of the examples of card payment systems.

Payment cards give people the power to purchase items in stores, on the Internet, through mail-order catalogs, and over the telephone. They save both customers’ and merchants’ time and money and thus enable them for ease of transaction.

Unstructured Supplementary Service Data (USSD)

In the event that you don’t have a cell phone or web office, still you can installments through dialing USSD (Unstructured Supplementary Service Data) code even from your fundamental telephone and adhering to the specific guidance, you can undoubtedly make your installments done. It is GSM-based innovation where exchanges happen through messages.

It is a stage that frames a medium between media transmission and banking monetary administrations by and large. For each banking application, you have an alternate dialing code that you need to check from your specialist organization while making the exchange of installments.

AEPS

Aadhaar Enabled Payment System (AEPS) is a bank-led model which allows online interoperable financial transactions at PoS (Point of Sale / Micro ATM) through the Business Correspondent (BC)/Bank Mitra of any bank using the Aadhaar authentication.

UPI

Unified Payments Interface (UPI) is a system that powers multiple bank accounts into a single mobile application (of any participating bank), merging several banking features, seamless fund routing & merchant payments into one hood. It also caters to the “Peer to Peer” collect request which can be scheduled and paid as per requirement and convenience. Each Bank provides its own UPI App for Android, Windows, and iOS mobile platform(s).

Mobile Wallets

A mobile wallet is a way to carry cash in digital format. You can link your credit card or debit card information in a mobile device to a mobile wallet application or you can transfer money online to the mobile wallet. Instead of using your physical plastic card to make purchases, you can pay with your smartphone, tablet, or smartwatch.

An individual’s account is required to be linked to the digital wallet to load money in it. Most banks have their e-wallets and some private companies. e.g. Paytm, Freecharge, Mobikwik, Oxigen, mRuppee, Airtel Money, Jio Money, SBI Buddy, Itz Cash, Citrus Pay, Vodafone M-Pesa, Axis Bank Lime, ICICI Pockets, SpeedPay, etc.

Banks Pre-paid Cards

Spending money is loaded onto the prepaid card in advance with a bank account debit card if you have “opted in” to your bank’s overdraft program. This means that your bank may charge you a fee for covering the cost of a purchase or ATM withdrawal that exceeds what you have in your account.

Point of Sale

A point of sale (PoS) is the place where sales are made. On a macro level, a PoS may be a mall, a market, or a city. On a micro level, retailers consider a PoS to be the area where a customer completes a transaction, such as a checkout counter. It is also known as a point of purchase.

Internet Banking

Internet banking, also known as online banking, e-banking, or virtual banking, is an electronic payment system that enables customers of a bank or other financial institution to conduct a range of financial transactions through the financial institution’s website. It includes National Electronic Fund Transfer (NEFT), Real Time Gross Settlement (RTGS), Electronic Clearing System (ECS), and Immediate Payment Service (IMPS).

Mobile Banking

Mobile banking is a service provided by a bank or other financial institution that allows its customers to conduct different types of financial transactions remotely using a mobile device such as a mobile phone or tablet. It uses software, usually called an app, provided by the banks or financial institutions for the purpose. Each Bank provides its own mobile banking app for Android, Windows, and iOS mobile platform(s).

Micro ATMs

Micro ATM is meant to be a device that is used by a million Business Correspondents (BC) to deliver basic banking services. The platform enables Business Correspondents (who could be local Kirana shop owners and will act as ‘micro ATM’) to conduct instant transactions.

Qr Code Based Payments System

QR code is again an alternate system of making the exchange of installments where you just need to check the QR code of the trader and do the exchange of installments. It is as a rule generally utilized by all the computerized installments applications like BHIM, other banking applications to make the exchange of installments without any problem.

The dark square holds the data about the things whereby filtering the code data gets sent consequently through the cell phone and installments complete. You don’t need to enter anything physically while utilizing the QR code office. Bharat QR code has been dispatched by the public authority to push the computerized installment activity in the right round.

Smart Card

The smart card was first introduced in Europe most of these methods are known as the stored-value card. A smart card is about the size of a credit card, made of plastic with an embedded microprocessor chip that holds important financial and personal information. The microprocessor chip is loaded with the relevant information and periodically recharged.

In addition to these pieces of information, systems have been developed to store cash onto the chip. The money on the card is saved in an encrypted form and is protected by a password to ensure the security of the smart card solution.

In order to pay via smart credit is necessary to introduce the card into a hardware terminal. The device requires a special key from the issuing bank to start a money transfer in either direction. Smart cards can be disposable or rechargeable.

Electronic Cheque

Electronic cheque is messages that contain all the information that is found on an ordinary Cheque but it uses digital signature for signing and endorsing and has the digital certificate to authenticate bank account. There are many websites that accept Electronic cheques. An electronic payment process that resembles the function of paper cheques but offers great security and more feature.

Electronic checks are typically used in orders processed online and are governed by the same laws that apply to paper checks. Electronic checks offer protective measures such as authentification and digital signatures to safeguard digital transactions.